Mutual funds up stake in Paytm, more retail investors jump on board as firm promises profitability

ANI

23 Jan 2023, 11:33 GMT+10

Noida (Uttar Pradesh) [India], January 23 (ANI): It has been just over a year since India's mobile payments and Quick Response (QR) pioneer Paytm made its debut on the stock market and the company has made quite an impression. The initial public offering (IPO), which was the largest in the country's history, drew attention from investors far and wide. Paytm's impressive growth has sparked the interest of savvy investors, both retail and institutional, who are clamouring to add more Paytm stock to their portfolios.

As the fintech firm continues to make significant strides towards achieving operating profitability, investors' belief in the Paytm story and the company's long-term potential for success has grown stronger than ever.

The company's latest shareholding pattern for the quarter ended December shows that mutual funds increased their stake by 0.47 per cent to 1.73 per cent. Two new mutual funds entered the stock, taking the total mutual fund shareholders in Paytm from 19 to 21 in the December quarter. Meanwhile, more retail investors have also jumped on board, with their shareholding increasing by 3 per cent to 9.7 per cent. Over 70,000 new investors were added during the quarter, bringing the total number of retail shareholders to around 12 lakh.

These developments are a clear indication that more Indians believe in Paytm's ability to deliver profitability without compromising on growth. The increase in domestic investors' shareholding is a vote of confidence in the company's future prospects.

Global investment firm Goldman Sachs expects Paytm to be adjusted earnings before interest, taxes, depreciation, and amortisation (Ebitda) positive by the March quarter, two quarters ahead of the estimates and the company's guidance of September 2023. Goldman Sachs has reiterated its 'Buy' rating for Paytm and has upwardly revised its share price target to Rs 1,120. The firm has stated that the current share price continues to offer a compelling entry point into India's largest and one of the fastest-growing fintech platforms.

The increase in shareholding by domestic investors is also a positive sign for the Indian economy, as it shows that more and more Indians are investing in the country's rapidly growing fintech sector. An increase in retail shareholding can bring a number of benefits for a company. One of the most significant benefits is increased liquidity, which can help to stabilise the stock price and improve overall market sentiment. Retail shareholders also tend to have a long-term investment horizon and may be more likely to hold on to their shares, making the company more attractive to investors.

The overall FDI shareholding in Paytm has declined from 71.49 per cent to 66.12 per cent, mainly because of SoftBank offloading a 4.53 per cent stake. The Japanese conglomerate, through its Vision Fund, continues to own 12.92 per cent of Paytm. Meanwhile, foreign portfolio investors (FPI) holding in the company has gone up by 0.91 per cent to 6.68 per cent. The number of FPIs holding the Paytm stock has increased from 88 to 128 in the third quarter, representing a net addition of 40 investors. As a pioneer in India's fintech revolution, Paytm has been at the forefront of the country's technology-driven shift towards a cashless economy. The Paytm Super App has become a household name that is synonymous with convenience and ease of use.

Paytm is expected to post another strong quarter when it announces Q3 (third quarter) results. Meanwhile, its Q3 operating performance update shows strong growth in monthly transacting users, loan disbursals and devices deployed. According to data available, eight out of 12 analysts tracking the company have a 'buy' rating. Paytm is also included in Goldman Sachs' Asia (ex-Japan) 'Conviction List' of stocks that have a high potential for returns and are rated as 'buy'. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Central Asia Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Central Asia Times.

More InformationInternational

SectionGaza War sucking life out of an Israeli generation

In the past month alone, 23 Israeli soldiers have been killed in Gaza—three more than the number of remaining living hostages held...

Faulty IT system at heart of UK Post Office scandal, says report

LONDON, U.K.: At least 13 people are believed to have taken their own lives as a result of the U.K.'s Post Office scandal, in which...

Travelers can now keep shoes on at TSA checkpoints

WASHINGTON, D.C.: Travelers at U.S. airports will no longer need to remove their shoes during security screenings, Department of Homeland...

Rubio impersonator used AI to reach officials via Signal: cable

WASHINGTON, D.C.: An elaborate impersonation scheme involving artificial intelligence targeted senior U.S. and foreign officials in...

Warsaw responds to migration pressure with new border controls

SLUBICE, Poland: Poland reinstated border controls with Germany and Lithuania on July 7, following Germany's earlier reintroduction...

Deadly July 4 flash floods renew alarm over NWS staffing shortages

WASHINGTON, D.C.: After months of warnings from former federal officials and weather experts, the deadly flash floods that struck the...

Asia

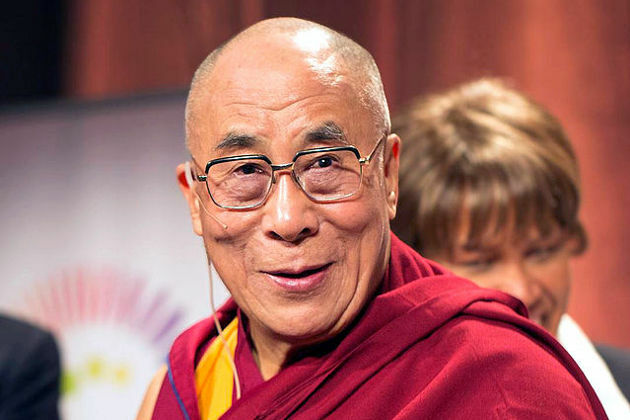

SectionThousands gather in Himalayas as Dalai Lama celebrates 90th birthday

DHARAMSHALA, India: The Dalai Lama turned 90 on July 6, celebrated by thousands of followers in the Himalayan town of Dharamshala,...

Beijing hits back at EU with medical device import curbs

HONG KONG: China has fired back at the European Union in an escalating trade dispute by imposing new restrictions on medical device...

Daily World Briefing, July 12

Chinese FM calls for joint efforts in finding right way for China, U.S. to get along China and the United States should work together...

Maratha Military Landscapes of India inscribed in UNESCO World Heritage List as India's 44th entry

New Delhi [India], July 12 (ANI): In a remarkable decision taken at the 47th Session of the World Heritage Committee, India's official...

Dmitry Trenin: Why the next world order will be armed with nukes

How the Wests recklessness is testing Moscows nuclear patience A multipolar world is, by its nature, a nuclear one. Its conflicts...

Italy script history, qualify for T20 World Cup 2026; Netherlands earn a spot as well

The Hague [Netherlands], July 11 (ANI): Italy made history after securing qualification for the 2026 Men's T20 World Cup in India and...